People are starting to have a case of FOMO (fear of missing out). Investors are wondering if they have missed out on the market bottom. Should they put more money into stocks when they see the market moving higher? This is an emotional response to watching your portfolio grow or decline. The trick is to take the emotion out of it and look at the underlying facts.

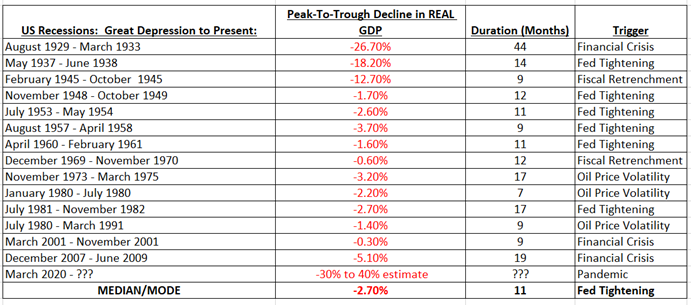

In a matter of weeks, we went from business as usual to almost no business at all. What you’re finding now on Wall Street is a debate between optimism and realism. Everything except equities is telling you that things are not great. In our opinion, this market is overly optimistic. Given all the stimulus in the system, markets can continue to move higher in the very short term but, they will eventually have to succumb to the reality of the economic data. Economic forecasters expect the U.S. economy to get much worse in the next few months. As a matter of fact, they are predicting the most severe economic downturn since the Great Depression. The average duration of a U.S. recession is 11 months. See chart.

In the first quarter of this year, the nation’s gross domestic product (GDP) fell an estimated 4.8% on an annualized basis; yet, the drop in the first quarter will only be a precursor to a far grimmer report to come on the current April-June period. With much of the economy paralyzed, the congressional budget office has estimated that economic activity (GDP) will plunge in the second quarter between a 30-40% annual rate.

Many economists are projecting that a recovery will begin in the second half of 2020 with annualized growth of better than 10%. The vigorous rise for stocks over the last month also implies investors see a relatively quick rebound for the economy and profits following the current economic devastation. The market seems to be more focused on the rewards of an economic bounce back as opposed to the economic risk right now.

Stock prices have been buoyed over the last month as the Treasury has injected $3 trillion of newly printed dollars into the economy. Investors have also been encouraged by the Federal Reserve’s unprecedented actions of purchasing corporate and municipal debt in the open markets. Lastly, the markets have been enticed by recent plans to begin reopening factories, retail and travel.

Professional investors are far more cautious about the current run up of the stock market. One note of caution comes from the similarity from the brief bull market from January ‘08 – January ‘09. Stocks jumped 27% in only 30 trading days then quickly reversed to what became the steepest equity correction since the Great Depression. Many professional investors, including us, are skeptical of the markets big rally. There’s still a lot of uncertainty of how long the recession will last and how severe it will be. There’s no single metric to tell us when the worst of the pandemic and economic fallout is behind us.

In order for the markets not to experience a second correction, it is our opinion every one of these assumptions currently built into stock prices will have to come to fruition:

– a complete reopening of the full U.S. economy within the next 30-60 days

– the American consumer fully reengaging in normal consumption (i.e. spending)

– the labor market reacquiring all or most of the 30 million unemployed workers

– sufficient testing/vaccine developed for the virus this year

– the economy not experiencing a second coronavirus outbreak

These are indeed unprecedented times in many ways. The news changes on a daily basis. Yet there is no one who can speak about the virus or the economy with complete certainty. Will the economy recover? Of course. Our estimate – at least now – is not until some time in 2021 will we see any type of economic activity that borders on “normalcy”.

Despite the optimism on Wall Street, it is our belief economic fundamentals still do matter when it comes to stock valuations. Even though this global pandemic has never occurred during our lifetimes, it’s hard to ignore historical trends. Our opinion, and our fiduciary responsibility to you as a client, is that the time to reenter the equity market may be soon (hopefully) but it is not now.

We continue to monitor market activity throughout each day. If you have any further questions or concerns please don’t hesitate to contact our office.

As always, we at Kapusta Financial Group, would like to thank you for the trust and confidence you place in our team.